Last Updated on July 8, 2022

If you are wondering how to increase transfer limit on access bank mobile application, you can follow the steps mentioned in this article. The limits are based on the amount of money you can transfer in a calendar month. In order to increase the transfer limit, you should first register in access bank by downloading the app from the app store or Google play. The app name is AccessMore. To sign up, click on the link below and follow the instructions. If you are already a member, you can follow the same steps as the new users.

Ussd code

If you have an Access Bank account, you may be wondering how to increase the daily transfer limit. First, you must be registered with the bank. In case you are not a member yet, you can download the app on the Google play store or the app store and search for it. AccessMore is the name of the app. You should follow the prompts to sign up for an account. If you already have an Access Bank account, you can simply follow the steps below.

Using the USSD code is simple and requires a small amount of data on your mobile device. If you are a new customer, you will need to dial the *901# number to get started. Once you‚ve entered the number, enter the 4 digit pin to verify your identity. This will increase your daily transfer limit to N2000. Then, you can use the USSD code to transfer N2000 to another account and continue using the app.

There are many benefits to using a USSD code to increase your Access Bank transfer limit. The first is that it‚s very convenient. USSD codes can be used for a variety of transactions. For example, a ussd code can be used for bill payments or money transfers from one bank to another. In addition, a USSD code is easy to remember. Lastly, USSD codes are available 24 hours a day.

Another benefit is that you don‚t need to be in a physical bank to perform these transactions. You can also perform banking operations with your phone. Many people do not know the USSD code to increase their transfer limit. This method is very convenient and can be done anywhere, anytime, from anywhere. However, it is important to remember that mobile banking is the fastest way to handle your financial transactions.

Hardware token

You can easily increase the amount of money you can transfer from your Access Bank account online by using a Hardware Token. If you don‚t have one, you can request for one at any Access Bank branch. To get one, simply follow the steps below. You will be prompted with a list of options, including how to increase your transfer limit. You can also use the same token to transfer money to other banks.

First, you must obtain a Hardware Token from your bank. Currently, your daily limit for in-app transactions is N100,000. If you have reached this limit, you will have to wait until the next day to make another transfer. If you want to transfer more than N100,000 per day, you must first visit an Access Bank branch and get a Hardware Token. This is a quick process that requires only a few minutes of your time.

After requesting a Hardware Token, you must be a registered member of Access bank to receive it. Download the app from the app market or Google Play to access the app. Fill out the application form and hand it to a customer service representative. After filling out the form, you will receive a serial number and an activation code. Present the registration code to the customer service representative to receive your Hardware Token.

To make an increase in your daily transfer limit, open your Internet Banking settings in the drop-down menu and click Change Limit. In the next window, you will be prompted to input the security code you received in your mobile phone. Then, follow the steps below. Your new daily fund transfer limit will be effective till you remove the enhancement. If you do not wish to use a Hardware Token, you can also get the same feature with a different bank.

Limits for payments made within a calendar month

If you use E-Banking, you may have limits for certain types of transactions such as ATM withdrawals, standard bill payments, and funds transfers outside the bank. If you are unable to meet these limits, you can ask the bank‚s Customer Service department to increase your limits. These limits apply to all payments made within a calendar month. A daily limit may be set at $8,000, but if you make multiple payments within the same day, you may not exceed this limit.

Requires internet connection

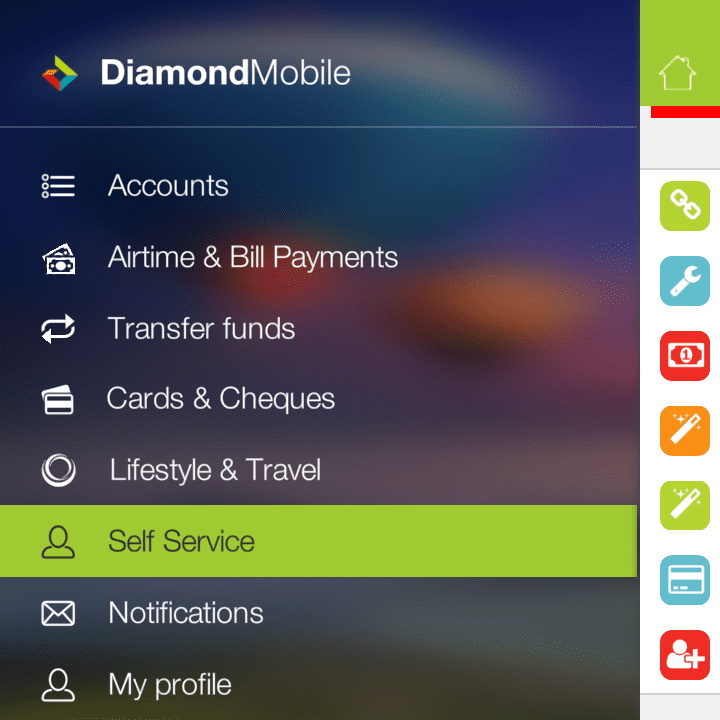

If you‚re wondering how to increase the transfer limit on your Access Bank mobile app, this article will provide you with the necessary information. First, you‚ll need to log in to your account. You‚ll need to tap the menu icon in the upper left hand corner of the app. From there, select limit maintenance. Once there, you‚ll edit your maximum transfer limit. You‚ll be prompted to enter your PIN in order to confirm your change. Then, tap ‚Save‚. Your maximum transfer limit will now be increased.

Once you‚ve installed the Access Bank mobile application, you‚ll want to increase the daily transfer limit. This limit applies to Verve, MasterCard, and Visa users. If you want to increase the limit on these cards, you‚ll need to visit your nearest Access Bank branch. A customer care representative can walk you through the process. Make sure you present your ID card and account documents when you visit the branch.

You can also increase the daily transfer limit in the mobile app by going into settings and choosing ‚Internet-based transfers‚. This process is referred to as DAM, or Download Access Bank Mobile Banking App. You can also use the Access Bank mobile app for java phones. If you‚re using an iPhone, you can go to the App Store and search for ‚Access Bank Mobile Banking‚.

Access bank has an excellent USSD code for transferring money. The USSD code for this service is *901#. Dial the USSD code, press send, and the bank staff will walk you through the next steps. Then, use your USSD bank code to make transfers to your account. The amount you transfer will be limited to N100,000 per day. After reaching the daily transfer limit, you‚ll have to wait until the next day to make another transaction.

About The Author

Scarlett Aguilar is an infuriatingly humble troublemaker. She's always up for a good time, and loves nothing more than reading evil books and playing typical video games. Scarlett also writes for fun, and finds everything about outer space fascinating. She's proud of her work, but would never brag about it - that's just not her style.